What is a target date fund? A target date fund is an investment that is designed to provide a reasonable risk/return trade off given the year you plan to begin withdrawing from the fund. It is a “fund of funds”, which means it is a mutual fund that owns other mutual funds. The idea is […]

Archives for 2020

Achieve Financial Freedom in 5 Steps

Financial independence isn’t created overnight. Have patience and take these steps 1 at a time. If you stay focused on improving your financial situation one step at a time, you will eventually achieve life’s greatest financial goal – financial freedom. To find out how you’re doing, take the short quiz below and get customized tips […]

Do You Have Enough in Your Emergency Fund?

What is an emergency fund? Your emergency fund is the amount of cash you have in a safe place to cover an unexpected expense (such as a car repair) or event (such as a layoff). You should always aim to keep the money in this account untouched unless an unforeseen event occurs. Why is it […]

Best Diaper Deals: Target vs. Amazon

In honor of our first child being born this month, I decided to take a break from my typical finance topics to explore something new: Diapers. While I have experience with financial planning, I am brand new to being a Dad (and the financial challenges that come with it). Will we switch from Pampers to […]

What to Look for in a Financial Advisor

Going into an initial meeting with a financial advisor for the first time can feel a bit like stepping into a cage fight. Your guard is up, but your opponent is a seasoned veteran that does this every day. How do you prepare when the person across from you is highly trained and you may […]

Invest Your Fidelity 403(b) Like a Pro

Doing the right things consistently with your retirement plan can have a huge impact on your financial future. That great opportunity can create stress if you’re not sure exactly what you should be doing with your investments. That is why I created this step-by-step guide: To help you take control of your 403(b) plan at […]

How to Save Money and Pay Off Debt in 5 Steps

There is certainly no shortage of financial advice out there – and it can be tricky to know what applies to you. Your co-worker may be telling you about how you need to save for your child’s education, but you haven’t yet paid off your own student loans yet – what do you do? Take […]

Recession Proof Your Finances in 5 Steps

Tip 1: Start thinking about it now The most common mistake people make isn’t necessarily being financially ready for a recession, it’s being mentally prepared for one. People tend to overestimate the upside, and underestimate the downside risk of their investments. This may be compounded by the comfort we all feel after a 10 year […]

What You Need to Know about the CARES Act

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on 3/27/20. It is the largest stimulus package in US history and will directly impact nearly every American. While the law is lengthy and still being analyzed, I have summarized the areas we will see benefit most of the public directly which […]

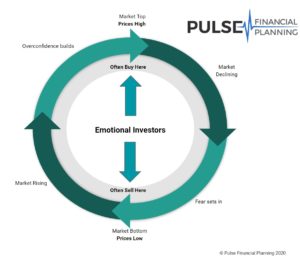

Don’t Let Fear Drive Your Investing

Update: This article was originally published March 24th, 2020. An update on how the Covid-19 pandemic impacted markets was added 1/25/2022. As you’re reading this, there is likely a major event in the news that may have you worried and is driving the stock market. The biggest mistake many individuals make is allowing fear hijack […]