Doing the right things consistently with your retirement plan can have a huge impact on your financial future. That great opportunity can create stress if you’re not sure exactly what you should be doing with your investments. That is why I created this step-by-step guide: To help you take control of your 403(b) plan at Fidelity.

This guide will walk you through the 5 steps you need to complete to manage your retirement account like a pro.

Step 1: Understand the Basics of Your 403(b)

It is common for people to never check their investments and many don’t even know how. Don’t be intimidated, your account is fairly intuitive to keep on top of. The first step is to login at www.netbenefits.com. If you’re experiencing issues, Fidelity can be reached at 800-343-0860 for help accessing your account.

Every employer creates their own set of rules around when you are eligible for the retirement plan, and when you are entitled to keep their matching contributions. Check with your HR department to determine when you are eligible and what your vesting schedule is. Vesting is just a fancy way of saying if you are entitled to the money in your account or not. Remember that:

- You are always 100% vested in your contributions. If you added the money, it is always yours.

- You may not be vested in all of your employer’s matching contributions until you have reached a certain number of years of service set by your employer.

Be aware that you may not receive the entire balance in your 403(b) if you separate from your employer prior to being fully vested. You will only receive your “vested” balance (your contributions plus earnings on those contributions). If you’ve been with your employer close to the amount of time required to be vested and are thinking of leaving – consider sticking it out for a few months if you can.

Step 2: Set Your Contributions

I recommend you at a minimum contribute the amount required to receive your full employer match.

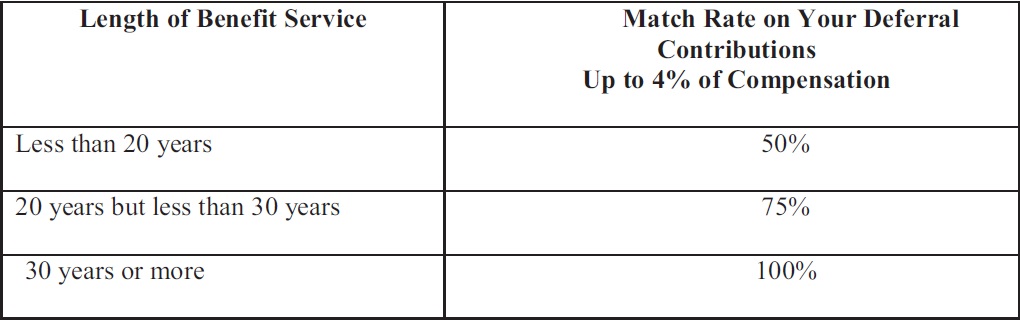

For example, let’s assume you are a nurse with 5 years of service that earns $60,000 and your employer offers the matching schedule to the left. Four percent of your salary is $2,400 of your own contribution. By doing this, your employer is agreeing to add $1,200 per year to your retirement account for you. This amounts to only about $92 from your paycheck for your employer to deposit the additional $1,200 throughout the year. The total contribution for the year will be $3,600 not counting any potential gains on your investments. If you don’t contribute, not only are you not saving for your own retirement, but you lose out on the $1,200 your employer would have otherwise put into your retirement account for you.

Contributions are made to your 403(b) via payroll deduction. This relatively small bi-weekly commitment will have a significant impact on your retirement in the long run. Your 403(b) is an essential benefit to take advantage of to ensure you will be able to retire. Your pension and social security alone likely will not be enough to maintain your lifestyle during retirement. Make sure you are taking advantage of this before doing anything else with your finances!

Consider increasing your contribution or maxing out your 403(b) if you have:

The maximum 403(b) employee contribution in 2021 is $19,500 or $26,000 for employees over age 50.

Roth or pre-tax?

Once you have decided the percentage of your paycheck you will contribute to your 403(b), you will also need to decide what type of contribution you will make: Pre-tax or Roth. You will owe tax either way, but the main question is when: on the seed or at the harvest (I’ll explain).

Pre-tax contributions mean just that – your contributions will be made before any taxes are deducted from your earnings. That means you will pay less tax in the current tax year, but will owe income tax on the amount of any withdrawals in the future. With pre-tax contributions, you pay tax during the “harvest” (when you take the money out).

Roth contributions are after tax, which means you will receive no tax benefit in the current year. However, when you make qualified distributions during retirement, the entire withdrawal will be tax free. That includes any earnings that may have accumulated in the account over the years. With Roth contributions, you pay tax on the “seed” (when you put the money into the account). The hope is that you pay tax now on a smaller balance and can reap the benefits of a larger tax-free withdrawal that includes years of investment growth.

So, which is better – pre-tax or Roth? The answer depends on your situation, as well as what congress does with future tax rates. While exactly what congress will do with tax rates when you are retired is unknown, we do know the Tax Cuts and Jobs Act is set to expire in 2025. That and many years of running a federal deficit means tax rates are likely go up in the future. Generally, if you think you will be in a higher tax bracket during retirement than you are now, Roth contributions are better. If you are in peak earnings years and expect to be in a lower tax bracket during retirement, pre-tax contributions may be better for you.

There are other considerations such as how long before you begin making distributions, where your income will come from during retirement, investment returns, and other factors. If you’re not sure what to do, ask your accountant or reach out to me and I’ll be happy to take a look at your situation.

Step 3: Discover Your Risk Tolerance

To know how your 403(b) should be invested, first you will need to learn your risk tolerance. If you already work with a good financial professional, they will be able to help you identify your risk tolerance and appropriate investment allocation in your 403(b).

If you haven’t already created a personal investment policy, take the short quiz below to find out your risk tolerance. This will help you identify an appropriate level of risk for your situation to incorporate into your investment plan (in step 4) in less than 5 minutes.

Step 4: Create Your Investment Plan

Most employers offer target date funds or a robo-advisor solution to help you manage your investments. This is a simple solution to start with, but as your balance grows, so does the management fee. If you aren’t sure if target date funds are right for you (for example, the Fidelity Freedom 2050 fund), check out my list of pros and cons of target date funds.

Create your investment plan (like a pro)

Once you know your risk tolerance, this will give you a good indication of how to allocate your investing plan. If you are looking for ideas of how much to put in each asset class, I have created the following portfolios for you to build off of.† Reminder: If you’re not sure which model may be appropriate for you, you can take my free risk tolerance questionnaire to find out.

| Asset Class | Conservative | Moderate | Balanced | Growth | Aggressive |

| Fixed Account & Short-Term Bonds | 48% | 37% | 30% | 15% | 4% |

| Intermediate Bonds | 18% | 13% | 4% | 0% | 0% |

| Long Term Bonds | 10% | 8% | 6% | 5% | 0% |

| Large Cap (Total) | 10% | 12% | 16% | 23% | 25% |

| Large Cap (Value) | 5% | 6% | 8% | 8% | 9% |

| Large Cap (Growth) | 3% | 4% | 8% | 10% | 14% |

| Mid Cap | 0% | 5% | 6% | 6% | 7% |

| Small Cap (Value) | 0% | 3% | 3% | 4% | 4% |

| Small Cap (Growth) | 0% | 0% | 0% | 3% | 3% |

| International (Developed) | 6% | 8% | 15% | 20% | 25% |

| International (Emerging) | 0% | 4% | 4% | 6% | 9% |

I believe strongly in a diversified, low cost, passive investing strategy. There are lots of great funds in your 403(b) to satisfy each of these asset classes to complete your portfolio. You can view the current list of investments in your account under the “Investments” tab. Fidelity includes plenty of research information their including fees, performance, and ratings.

I recommend specific mutual funds based on an individual’s overall financial situation. If you’re not sure which investments to choose, I invite you to schedule a complimentary consultation with me to find out which funds may make sense for your situation.

Step 5: Implement and Monitor Your Investments

When you know the percentage you want to allocate to each fund, you are ready to implement the investments in your account. It is important that you make sure you:

- Exchange your current investments

- This will change how the existing funds in your 403(b) are allocated.

- Change your future investment elections

- This will ensure your future contributions get allocated according your investment plan.

- Rebalance quarterly

- This keeps your portfolio on track with your intended investment plan. If you don’t rebalance, your portfolio will drift over time and may not act as it was intended. Some employers have an automatic rebalancing feature, and some require this to be done manually.

I created a free step-by-step guide on how to make each of these changes when logged into your Fidelity account. If you would like a walkthrough of how to make these changes to your 403(b), download the free guide here.

Once you have implemented your investments, make sure you are sticking to your long-term investing strategy. Remember that you are investing for the long term and to stay the course.

Did you find this article helpful? Share it with a loved one, subscribe to our newsletter, or like us on Facebook to stay informed with other exclusive content!

†Investment portfolios and risk tolerance questionnaire are provided for educational purposes only. This is not intended as investment advice. Consult with a financial professional for investment advice that takes into account your complete financial situation before making changes to your strategy.