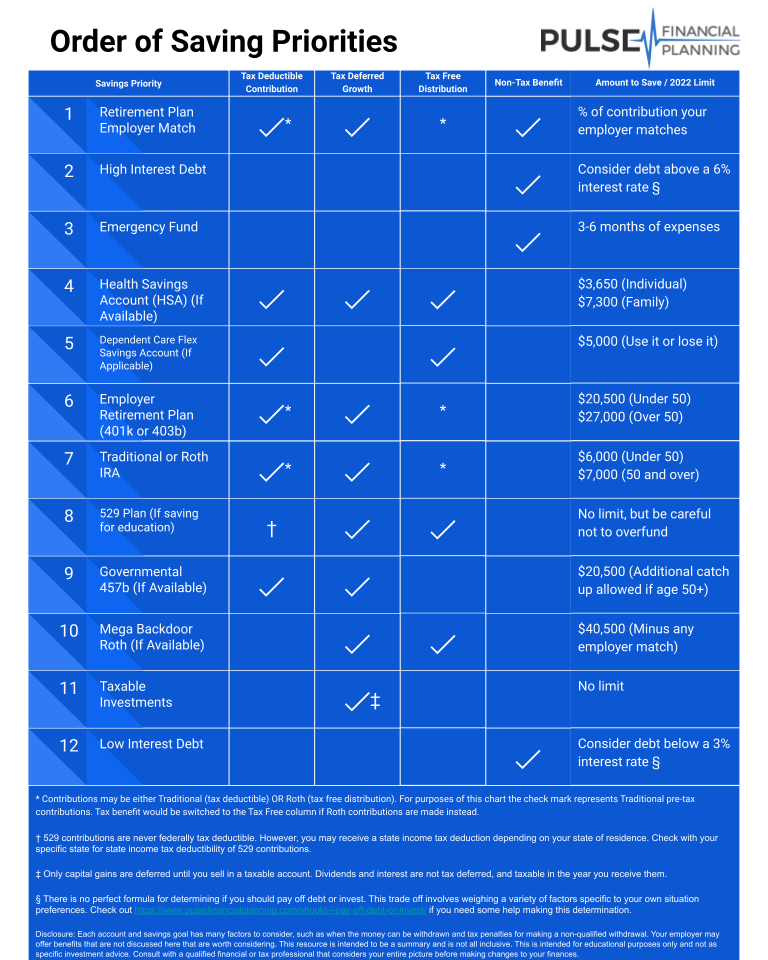

Saving money is only half the battle when it comes to managing your finances effectively. Where you put that money has an immense impact on reaching your long-term financial goals.

Do you keep money in the bank, pay off debt, or invest it one of a variety of tax advantaged accounts? Failing to make the right choice can result in leaving cash on the table, tax inefficiencies, and excessive interest expenses. By following the Order of Saving Priorities (below), you can optimize the effectiveness of each incremental dollar you save.

- Retirement Plan Employer Match: Common account types are 403b and 401k. Typical amounts your employer may match is 3-6% but is set by your employer. If you don’t contribute enough to get your employer’s match, you are leaving money on the table making this a #1 savings priority.

- High Interest Debt: Paying off high interest debt will save you on expensive interest payments and get you on track for a solid financial foundation.

- Emergency Fund: Having a fully funded emergency fund is crucial to avoid going into debt to pay unforeseen expenses. Consider adding any short-term goals to this amount such as a down payment for a house or other large upcoming expense.

- Health Savings Account (HSA): HSAs are only available if you have a High Deductible Healthcare Plan (HDHP). Don’t sign up for a HDHP if it is not the right health plan for you just to gain access to an HSA. If you are not eligible for an HSA and have known medical expenses, consider a Healthcare FSA. Healthcare FSA’s lacks many of the benefits of an HSA – the key one being you typically cannot carryover a balance like you can in a HSA. However, a Healthcare FSA may still be a good solution to pay for your current medical expenses tax free.

- Dependent Care Flex Savings Account (DCFSA): Only use a DCFSA if you have eligible childcare expenses and a DCFSA is right for you. Depending on your situation, you may be better off utilizing the Child and Dependent Care Tax Credit instead. This is an account that can only be offered through your employer.

- Maximize Employer Retirement Plan: Depending on your investment options, existing retirement accounts, tax situation, state, and goals, priorities 6, 7, and 8 may be interchangeable.

- Maximize Traditional / Roth IRA: Depending on your Modified Adjusted Gross Income (MAGI), you may not be eligible to contribute directly to a Roth IRA or deductible Traditional IRA. Consider doing this as a “Backdoor Roth IRA” if necessary.

- 529 Plan: There are various ways to save for college, the most popular being a 529 plan. Most college savings strategies don’t involve maximum contributions. Be careful not to overfund college savings accounts to avoid penalties if the money goes unused. In addition, be aware of any gift/estate tax implications for large contributions.

- Governmental 457b (If Available): These plans are only available if your employer offers it for employees earning more than $130,000 per year. Check with your employer to verify if you have a “Governmental” or “Non-Governmental” plan. Non-governmental plans have some major draw backs, but could still be worthwhile depending on the distribution options made available to you. Dr. Dahle of the White Coat Investor has a good resource available here for considerations with regards to 457 plans.

- Mega Backdoor Roth (If Available): This strategy only works if your employer retirement plan allows after tax contributions and in-service non-hardship withdrawals. Many plans do not allow this which makes the Mega Backdoor Roth unavailable. If they do allow it, make sure the plan sponsor understands what you are doing and you file the proper tax forms.

- Taxable investments: If you must save in a taxable account, consider utilizing tax mitigation strategies such asset location and tax loss harvesting.

- Low Interest Debt: Paying off debt vs investing comes with various factors worth considering. There is no perfect right or wrong answer here. It depends on a variety of factors including the interest of your debt, time horizon, and risk tolerance.

These are all topics we pro-actively help existing clients plan for on an ongoing basis. Please note that some of these account types may not be available to you, or may not make sense to utilize depending on your situation. It is important to consider your complete financial picture when deciding where to save.

If you could use some help prioritizing where to save your money, we’re happy to help by offering a complimentary 30 minute consultation to get your questions answered.