There is no shortage of financial noise out there – and it can be tricky to know what applies to you. Your co-worker may be telling you about how you need to save for your child’s education, but you haven’t yet paid off your own student loans yet – what do you do? These 8 […]

Financial Plan Creation

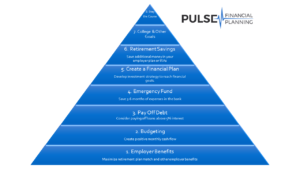

Where to Save Your Next Dollar

Saving money is only half the battle when it comes to managing your finances effectively. Where you put that money has an immense impact on reaching your long-term financial goals. Do you keep money in the bank, pay off debt, or invest it one of a variety of tax advantaged accounts? Failing to make the […]

Financial Tips for Nurses (Video)

I was honored to be invited to speak as a part of #NurseWellBeingWeek. Check out the Instagram Live recording for the full interview as I share some of my tips to help nurses achieve their own financial well-being. View this post on Instagram A post shared by NurseGrid (@nursegrid)

Should I Pay Off Debt or Invest?

As a financial planner, I get the question “Should I pay off my debt or invest?” all the time. Keeping the money in the bank, paying off debt, or investing may be the best choice depending on your situation. In this article, we’ll examine when each one of these options may make sense depending on […]

Retirement Readiness Checklist

When and how to retire may be one the largest financial decision you will make. This generates many new financial questions you may not have dealt with before: Where will my income come from? Have I saved enough? When should I draw Social Security? What should I do with my pension and retirement accounts? How […]

Guide to Get Your Finances Organized for 2021

You need to get your finances organized for two people: 1. For yourself. Not feeling in control of your finances can lead to stress and anxiety. It is impossible to make informed financial choices without first understanding where you are. You deserve the peace of mind that comes with knowing you are taking steps to […]

Achieve Financial Freedom in 5 Steps

Financial independence isn’t created overnight. Have patience and take these steps 1 at a time. If you stay focused on improving your financial situation one step at a time, you will eventually achieve life’s greatest financial goal – financial freedom. To find out how you’re doing, take the short quiz below and get customized tips […]

Do You Have Enough in Your Emergency Fund?

What is an emergency fund? Your emergency fund is the amount of cash you have in a safe place to cover an unexpected expense (such as a car repair) or event (such as a layoff). You should always aim to keep the money in this account untouched unless an unforeseen event occurs. Why is it […]

Invest Your Fidelity 403(b) Like a Pro

Doing the right things consistently with your retirement plan can have a huge impact on your financial future. That great opportunity can create stress if you’re not sure exactly what you should be doing with your investments. That is why I created this step-by-step guide: To help you take control of your 403(b) plan at […]

How to Save Money and Pay Off Debt in 5 Steps

There is certainly no shortage of financial advice out there – and it can be tricky to know what applies to you. Your co-worker may be telling you about how you need to save for your child’s education, but you haven’t yet paid off your own student loans yet – what do you do? Take […]