There is no shortage of financial noise out there – and it can be tricky to know what applies to you. Your co-worker may be telling you about how you need to save for your child’s education, but you haven’t yet paid off your own student loans yet – what do you do? These 8 […]

Making Sense of Your Mayo Pension Choice

Mayo Clinic is offering a one-time choice to make regarding your pension benefit from 8/14/2023 through 9/15/2023. Here is a summary what you need to know: What is changing You have the option to change how your future pension benefit is calculated to the new Stable Lump Sum Formula by logging into www.mayoemployees.org between 8/14/23 and […]

Biden Cancels $10k – What You Need to Know

President Biden announced major changes to student loans 8/24/22. There is much more than just widespread student loan cancellation to consider here. Here is what you need to know: $10,000 student loan cancellation for federal student loan borrowers Income must be below $125,000 if single, $250,000 if married filing jointly to qualify Income will be […]

Student Loan Pause Extension Update

The Biden administration extended the pause on federal direct student loan payments and interest through 8/31/22. Previously expected to resume in May 2022, this marks the 6th extension of the pause originally started back in October 2020 by the Trump administration. I don’t expect this to be the final extension, either. While previous extensions were […]

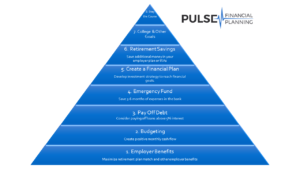

Where to Save Your Next Dollar

Saving money is only half the battle when it comes to managing your finances effectively. Where you put that money has an immense impact on reaching your long-term financial goals. Do you keep money in the bank, pay off debt, or invest it one of a variety of tax advantaged accounts? Failing to make the […]

Should I Refinance My Mortgage?

Interest rates remain extremely low, which makes now a good time to consider refinancing your mortgage if you haven’t already done so in the past few years. Refinancing can be a good option for those that: Own at least 20% equity in your home Have good credit Acquired the mortgage when interest rates were higher. […]

Student Loan Pause Extended to May 2022

Federal direct student loans were scheduled to begin February 2022. It looks like that has been pushed back, yet again, to May 2022. President Biden announced 12/22/21 that due to the Omicron variant and other factors, he is extending the pause on payments and interest for federal direct student loans until May 1, 2022. The […]

2021 Year End Financial Checklist

With the end of the year fast approaching, it’s time to review some key areas of your finances if you haven’t done so already. Things to consider before the end of the year: Tax loss/gain harvesting Review and update 401k/403b contributions Review Flex Savings Account balances Take Required Minimum Distributions Rebalance investments Contribute to 529 […]

Tips to Deal With Inflation (Video)

Inflation rates have recently risen to levels we haven’t seen in 30+ years. Sustained inflation can cause real challenges as your purchasing power degrades over time. If higher prices are creating a strain on your finances, there are 3 things you can do to minimize the impact: Reduce consumption (Budget) Increase income (Pick up shifts […]

Financial Tips for Nurses (Video)

I was honored to be invited to speak as a part of #NurseWellBeingWeek. Check out the Instagram Live recording for the full interview as I share some of my tips to help nurses achieve their own financial well-being. View this post on Instagram A post shared by NurseGrid (@nursegrid)