Update: This article was originally published March 24th, 2020. An update on how the Covid-19 pandemic impacted markets was added 1/25/2022.

As you’re reading this, there is likely a major event in the news that may have you worried and is driving the stock market. The biggest mistake many individuals make is allowing fear hijack financial decision making. If you let emotion drive your investing decisions, your finances will suffer. In this article, we’ll review the impact market volatility has had in the past on investments, and what you should do in the face of the next market downturn.

Past market volatility events:

You can always find a reason not to invest. Whatever headline you’re reading about today probably feels like the “real deal”. Maybe it is, but unless you react in a calm and calculated manner, your investments will control you instead of you controlling them.

I’ve seen short term stock market fear damage many long-term financial futures. This happens when we make long term investing decisions (5+ years) based on events that recover in less than that amount of time. Consider your time horizon not only when you initially implement your investments, but also when you are considering making changes to your investments.

| Year | Event | Recovery (Time from market bottom back to pre-event S&P 500 price) |

| 2008-2009 | The Great Recession | 4 years |

| 2010 | Flash Crash | 1 day |

| 2011 | US credit downgraded for first time | 6 months |

| 2015 | Greek debt crisis | 2 months |

| 2016 | Brexit | 2 weeks |

| 2019 | China trade war | 3 months |

| 2020 | Coronavirus pandemic | TBD* |

*1/25/2022 update: As of the original publishing of this article (March 24, 2020), fear was sweeping financial markets due to the Covid-19 pandemic. The day before this article was originally published, the S&P 500 reached it’s low of 2,191.86. This marked a 35.4% decline in just 1 month. From there, markets began a rapid recovery, fully recovering all losses in under 6 months.

The market continued to reach all time highs, before hitting a rocky start to 2022, primarily due to concerns over inflation pressures on the Federal Reserve’s monetary policy. As of 1/25/22, the S&P 500 was down 10% YTD in 2022. So what would have happened if you owned the S&P 500 and stayed invested from the top of the market prior to Covid-19 (2/19/20) and held until 1/25/22? You would still be up 27% on your holdings, even with the initial 35.4% drop in 2020 and recent 10% decline in 2022.

Each one of these events was a very big deal at the time and caused many individual investors to make poor investing decisions. It is true that these events had an impact on the stock market and caused real financial pain. It is also true that the stock market and economy recover in the long run.

One thing we know is these types of volatile events will continue. What we don’t know is exactly what they will be or how long it will take to recover. Typically the largest gains are in the very beginning days of the recovery, so if you jump out of the market – you may miss some of the largest gains at the front end of the recovery. You already participated in the risk on the way down, you should stay put to participate in the recovery as well.

Should I time the market?

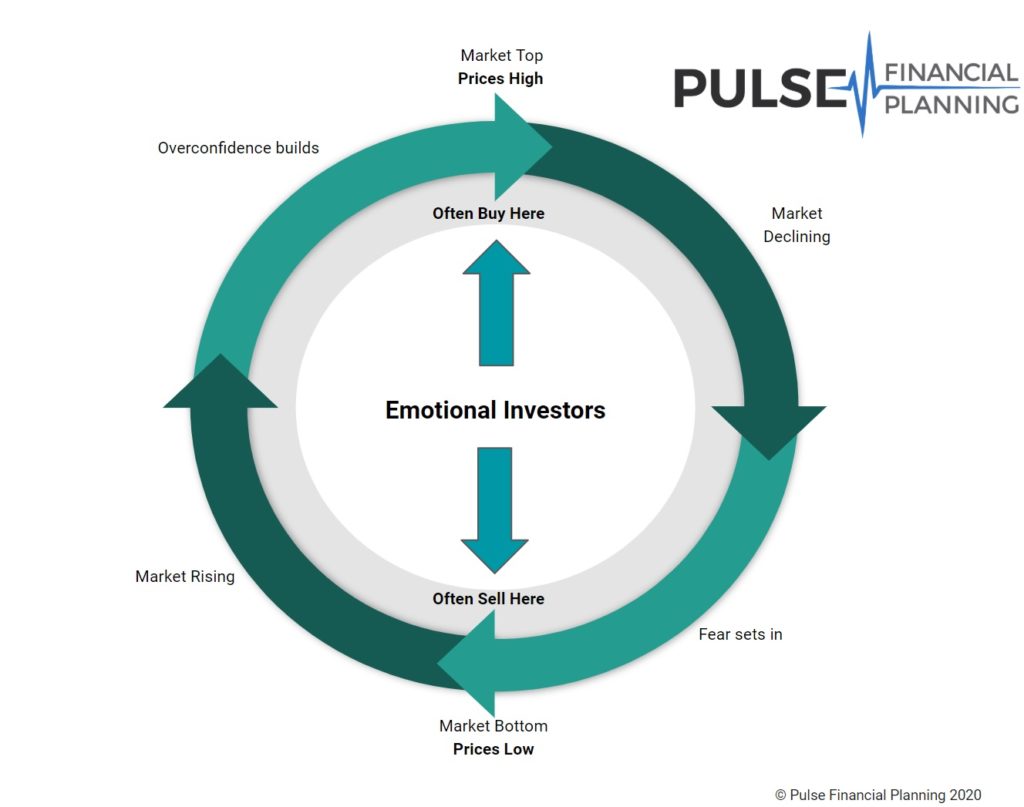

We all know the first rule of investing – buy low and sell high. Due to the emotional nature of investing, many end up doing the opposite of this by trying to time the stock market. When we look at our accounts and see how much money we lost, and then are bombarded with news reports in the midst of a crisis, fear can hijack a sound investing strategy.

Investors that base their investing decisions on emotion end up selling near the bottom of the market. As the recovery sets in, overconfidence builds and fear of missing out takes over, causing emotional investors to buy near the market top. The cycle repeats, and as a result, the majority of individual investors historically underperform stock market index returns.

Don’t be an emotional investor. By the time you’ve heard about the news, so has everyone else and you can bet that it is already priced into your investments. So take a deep breath and stay the course. If you’ve prepared, diversified your investments and invested according to your time horizon, you have nothing to worry about.

Implementation

The short answer to “Should I really invest (or stay invested) when the sky is falling in the news” is this:

Yes, this event could cause your investments to temporarily decline. If you’re investing right, it won’t matter. This is one of the few cases where doing nothing is likely your best course of action.

If you don’t already have an investing plan in place, or have difficulty sticking to it, you may benefit from working with a financial planner. A good financial planner will help you create a written financial plan, and help you stay on track with levelheaded decisions – particularly during volatile and emotional times.

If you choose to hire a financial professional, I recommend first reviewing What to Look for in a Financial Advisor to ensure whoever you hire, you can feel comfortable that they have your best interest at heart.

Did you find this article helpful? Share it with a loved one, subscribe to our newsletter, or like us on Facebook to stay informed with other exclusive content!