A “robo-advisor” is an online technology that provides automated financial services. Pioneered by Betterment in 2010, they have increased in popularity over the past decade with dozens of companies offering these services today.

So when does it make sense to hire a financial planner or utilize a robo-advisor? The first question to ask yourself is if the money should be invested in the first place.

Before jumping into the stock market, you should be in a good position to start investing:

- Have at least 3-6 months of expenses in your bank account. If you are in an employment situation that is not stable, this number should be 9-12 months.

- Don’t plan to use the money for any short-term goals (such as a down payment or vacation) within the next 5 years.

- Take advantage of your employer’s benefits, particularly a retirement plan with employer match if you have one available.

- Have a plan for student loans if you have them.

- Pay off high interest debt. Consider paying off loans that are at a 5% interest rate or higher.

If you already meet the above criteria and still have extra cash, you have 2 major considerations when looking to invest the money:

- Make sure you’re mentally prepared for investment risk

- Consider your situation for the best account to invest in – a Roth IRA, your employer retirement plan, trust, or a taxable account.

Robo-Advisor

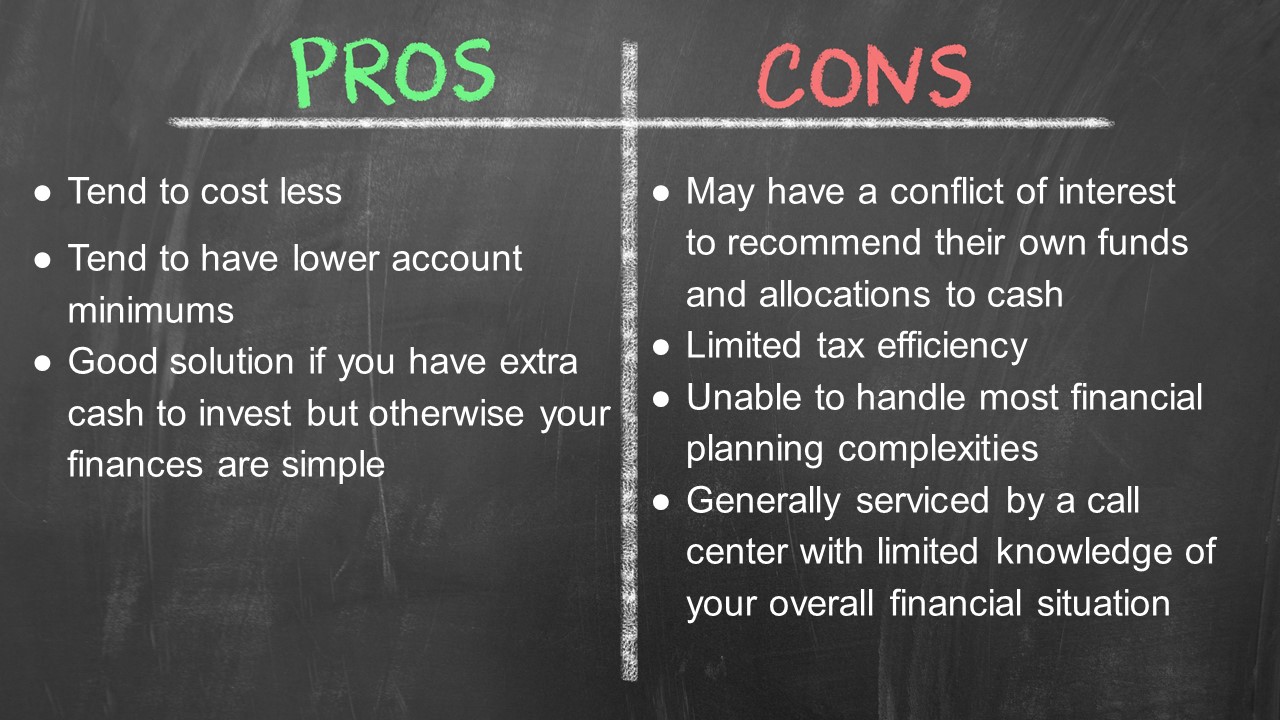

One of the most attractive features of using a robo-advisor is the cost. Popular options cost around .25% which is much less than the industry average of 1% for a financial advisor. They also tend to have low account minimums. Many robo platforms have just a $5,000 minimum and some may be less.

While working with a robo-advisor reduces the risk of getting put into commission-based products by a salesperson, some conflicts of interest do still exist. Some robo-advisors may keep more of your money in cash than may be optimal. One source of revenue for robo-advisors is lending the free cash in client accounts. This can lead to models that allocate significant portions of your investment to cash positions. This is particularly true if the platform has very low or no management fees at all.

Some robo-advisors may only recommend their own proprietary funds. For a robo-advisor that also offers their own mutual funds, you will most likely be invested only those funds to generate extra revenue for the firm, regardless of if they are the best ones or not.

Another potential con of a robo-advisor is they tend to be limited in tax efficiency. They generally only have the ability to sell everything you already own and invest it in a pre-selected portfolio. This can create tax consequences if you are dealing with an existing taxable portfolio. You are also on your own if you need help with other tax planning strategies such as navigating an efficient retirement withdrawal strategy or contributing to a back-door Roth IRA.

For any financial questions, you will generally be subject to a call center rather than a dedicated professional that knows your situation. For those that prefer using technology over dealing with a person, this may be viewed as a positive.

A robo-advisor may be a good solution if you have extra cash to invest but otherwise your financial situation is simple or if you are willing to do most of the financial planning heavy lifting on your own.

Financial Planner

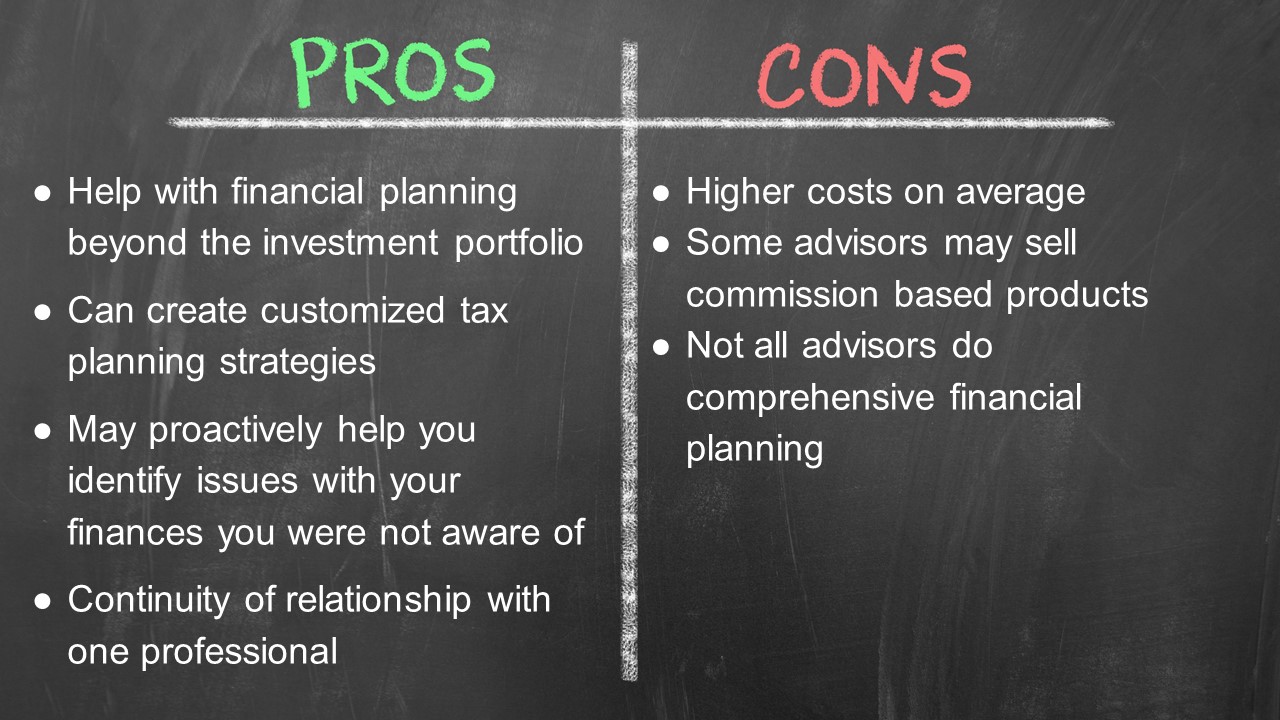

A financial planner will have the ability to cover more topics and be more proactive in nature than a robo-advisor. In addition to investment strategies, a financial planner should cover:

- Organizing finances

- Budgeting

- Paying off debt

- Financial education and coaching

- Managing investment behaviors

- Strategies to reach financial goals

- Early retirement

- Buying / upgrading home

- Vacations

- College funding

- Other goals

- Financial security

- Emergency fund

- Review insurance

- Estate plan

- Tax efficiency

- Customized portfolios for your tax bracket and investment location

- Retirement account type recommendations

- Retirement income strategies

- Roth conversions and other tax planning strategies

While a good financial planner will cover these topics, not all do, so it is worth asking before you hire one.

The major downside of working with a financial planner when compared to a robo-advisor is that they cost more on average. Some advisors may also sell commission-based products that you don’t need and have high account minimums.

If you decide a financial planner is the right choice for you, I recommend working with a fee-only (no commission) Certified Financial Planner™ professional.

Bottom line:

If you’re looking for a simple long-term solution to sock away some cash sitting in the bank not earning any interest and don’t have more complex needs, a robo-advisor may be a good fit.

If you have financial needs that going beyond just allocating your investments, a human advisor may be the better option. To reduce conflicts of interests, consider hiring a fee-only Certified Financial Planner™ professional over a commission based financial advisor.

Did you find this article helpful? Share it with a loved one, subscribe to our newsletter, or like us on Facebook to stay informed with other exclusive content!